Cash is the lifeblood of a business. Even profitable firms can fail if they do not have enough cash available to pay their bills when they fall due. Cash flow forecasting and management are therefore critical.

Cash versus profit

Profit is the excess of revenue over expenses during a period, whereas cash refers to the money available to spend. A business can be profitable but still experience cash shortages if revenue is not received in time to meet payments.

The cash flow cycle

The cash flow cycle tracks how cash flows into and out of a business:

- Cash is used to buy resources and pay expenses.

- Goods are produced or services delivered.

- Goods are sold and revenue is generated.

- Customers pay for goods, bringing cash back into the business.

Delays in receiving payments can create cash shortages.

Cash flow forecasts

A cash flow forecast is a plan of expected cash inflows and outflows over a period (often monthly). It helps firms anticipate shortages and take action in advance. The main elements of a forecast are:

- Cash inflows – money received, such as sales revenue, loans received, or capital from owners.

- Cash outflows – payments such as purchases, wages, rent, utilities and loan repayments.

- Net cash flow – inflows minus outflows.

- Opening and closing balances – the amount of cash at the start and end of each period.

Forecasts enable managers to plan for financing needs and identify periods where cash surpluses can be invested.

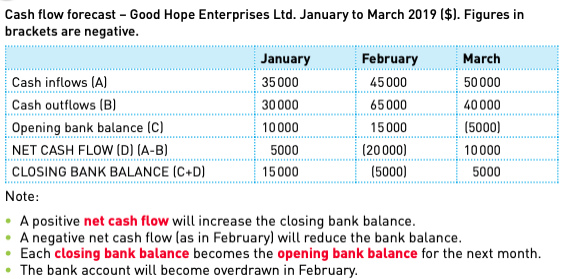

Example cash flow forecast

The figure below shows a monthly cash flow forecast with inflows, outflows, net cash flow and opening and closing balances. Such forecasts help managers anticipate shortages and arrange finance if needed.

Working capital

Working capital is the capital needed to finance day‑to‑day operations. It is calculated as current assets minus current liabilities. Adequate working capital ensures that a business can pay its short‑term debts and operate smoothly.

Improving cash flow

To prevent cash flow problems, businesses can:

- Encourage customers to pay promptly by offering discounts or enforcing stricter credit terms.

- Delay payments to suppliers where possible (but maintain good relationships).

- Reduce inventory levels using just‑in‑time systems.

- Arrange short‑term finance such as overdrafts or factoring.

- Lease rather than buy expensive equipment.

- Manage seasonal fluctuations by saving surpluses from peak periods.

Good cash flow management helps businesses survive and grow.

| Strategy | Description | Impact on cash flow |

|---|---|---|

| Offer discounts for prompt payment | Encourage customers to pay early by giving small price reductions. | Speeds up cash inflows, though reduces revenue slightly. |

| Delay payments to suppliers | Negotiate longer credit terms with suppliers. | Slows down cash outflows, improving liquidity. |

| Reduce inventory levels | Use just‑in‑time methods to minimise stock. | Frees up cash tied in stock; risk of stock‑outs if demand spikes. |

| Use overdraft or short‑term loan | Arrange a facility with the bank for temporary borrowing. | Provides immediate cash but incurs interest. |

| Factoring | Sell trade receivables to a finance company. | Instant cash inflow but reduces total amount received. |

Examples and applications

Consider a landscaping business that expects to receive $5,000 from a large client in May but must pay wages, fuel and equipment costs in April. A cash flow forecast will highlight the shortfall in April and allow the owner to arrange an overdraft or delay non‑essential purchases. By offering a small discount for early payment, the business might persuade the client to pay sooner, improving cash flow.

Working capital varies by industry. Supermarkets receive cash from customers immediately but pay suppliers later, so they often have strong cash flows. Construction companies, however, spend money on materials and labour long before receiving payments, making cash flow management critical. Seasonal businesses like ice cream vendors must save surplus cash earned in summer to cover expenses in winter.