A statement of financial position, also known as a balance sheet, shows the financial position of a business on a particular date. It lists the business’s assets, liabilities and owner’s equity.

Main elements

- Non‑current assets – long‑term assets used for more than a year, such as land, buildings, machinery and vehicles. These may depreciate over time.

- Current assets – items that are expected to be turned into cash within a year, including inventory (stock), trade receivables (debtors) and cash.

- Current liabilities – debts that must be repaid within a year, such as trade payables (creditors), bank overdrafts and short‑term loans.

- Working capital (net current assets) – current assets minus current liabilities. A positive figure indicates liquidity.

- Non‑current liabilities – long‑term borrowings repayable after more than one year, such as mortgages and debentures.

- Net assets – total assets minus total liabilities.

- Owner’s equity – the owners’ claim on the business, which may be called capital employed. For companies, equity consists of share capital and retained earnings. The accounting equation is: \(\text{Assets} = \text{Liabilities} + \text{Equity}.\)

Depreciation and intangible assets

Depreciation spreads the cost of a tangible non‑current asset over its useful life. Methods include straight line and reducing balance. Intangible assets are non‑physical items such as patents, trademarks and brand names that have value.

Uses and limitations

Statements of financial position help assess the liquidity and financial stability of a business. They show whether the firm has enough assets to cover its debts and how it finances its operations. However, they are a snapshot at one point in time and may not reflect current market values or the future earning potential of assets.

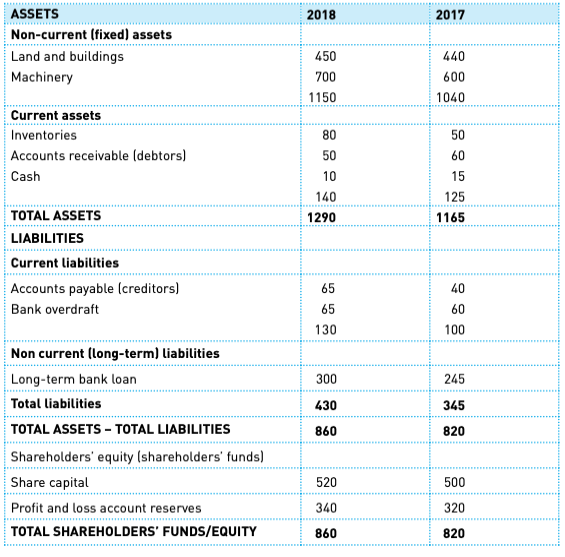

Statement of financial position example

The figure below presents a simplified statement of financial position comparing two years. It lists non‑current and current assets, liabilities and shareholders’ equity to show the net assets of the business.

Examples and applications

Suppose a small gardening business owns tools and a van worth $10,000 and a small workshop valued at $40,000. It also has $5,000 worth of plants and supplies and $3,000 owed by customers (trade receivables). These make up its assets. On the other side, the business owes $20,000 on a bank loan (non‑current liability) and $4,000 to suppliers (current liability). The statement of financial position will show assets of $58,000, liabilities of $24,000 and therefore owner’s equity of $34,000 (58,000 – 24,000).

Analysing a balance sheet helps stakeholders judge whether the business can pay its debts. If current assets (cash, inventory and receivables) total $8,000 and current liabilities are $4,000, the business has working capital of $4,000 and appears liquid. However, old equipment might be listed at cost even though its market value has fallen, and valuable intangible assets like brand reputation may not appear at all. For this reason, statements of financial position should be read alongside other financial reports and non‑financial information.