Businesses operate within an economic environment that can have a major impact on their performance. Governments use policies to influence economic variables such as growth, inflation and unemployment, and businesses must adapt to these changes.

Business cycle

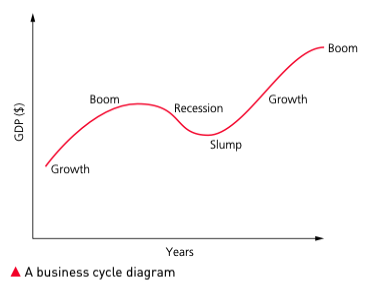

The economy tends to move through a business cycle consisting of periods of growth (boom), slowdown (recession), slump and recovery. During a boom, demand rises, unemployment falls and businesses invest. In a recession, demand declines, unemployment rises and firms may cut costs. Understanding the cycle helps businesses plan ahead.

Government economic objectives

Governments typically aim for:

- Economic growth – increasing the output of goods and services in the economy.

- Low unemployment – ensuring as many people as possible have work.

- Stable prices (low inflation) – avoiding sharp rises in the general level of prices.

- Balance of payments stability – balancing the value of imports and exports.

- Fair distribution of income – reducing extreme income inequalities.

Fiscal and monetary policy

Fiscal policy involves government decisions on taxation and public spending. Cutting income or sales taxes increases households’ disposable income and boosts consumption, while raising taxes reduces demand and helps curb inflation. Governments can also increase public spending on infrastructure, education or welfare to stimulate economic activity and employment. Conversely, they may cut spending to reduce budget deficits during booms.

Monetary policy is managed by a country’s central bank. It controls the money supply and the cost of borrowing by setting interest rates, conducting open‑market operations (buying or selling government securities) and, when necessary, using quantitative easing to inject money into the economy. Lower interest rates encourage borrowing and investment; higher rates discourage credit, helping to control inflation.

Supply‑side policies

Governments use supply‑side policies to improve the efficiency and competitiveness of the economy. Common measures include investing in education and training to raise labour productivity, reducing regulation and bureaucracy, improving infrastructure such as transport and telecommunications, and offering incentives for research and development. Supply‑side reforms are designed to boost the economy’s productive capacity in the long term rather than stimulate demand in the short term.

Sustainable development

Sustainable development means meeting the needs of the present without compromising the ability of future generations to meet their own needs【567776379330427†L155-L164】. It requires balancing economic growth with social inclusion and environmental protection【567776379330427†L155-L164】. Businesses play a key role in sustainability by using resources efficiently, reducing waste and emissions, and treating workers and communities fairly.

Benefits of sustainable practices:

- Long‑term viability – reducing reliance on finite resources and ensuring supply chains are resilient.

- Cost savings through efficiency – measures such as energy‑saving equipment, waste reduction and recycling can lower operating costs.

- Enhanced brand image – consumers and investors increasingly favour companies with strong environmental and social credentials.

- Access to new markets and finance – compliance with environmental standards can open up government contracts and attract sustainability‑focused investment.

Limitations and challenges:

- Initial costs – investing in cleaner technology or training staff can be expensive.

- Trade‑offs – decisions may involve balancing profitability against environmental and social objectives.

- Supply chain constraints – companies are dependent on suppliers adopting sustainable practices.

- Benefits may take time to materialise – the payback period for sustainability investments can be long.

Exchange rates

An exchange rate is the price of one currency in terms of another. When a currency appreciates (strengthens), its value rises relative to other currencies; when it depreciates (weakens), its value falls.

Appreciation makes exports more expensive to foreign buyers and imports cheaper. Consumers benefit from lower prices for imported goods and businesses that rely on imported inputs see their costs fall. However, exporters may suffer from reduced demand because their products become more expensive【141601244980680†L343-L360】.

Depreciation makes exports cheaper and more competitive overseas but raises the cost of imported inputs and consumer goods. Higher import prices can lead to inflation and squeeze profit margins, although exporters may enjoy increased sales【718435290749720†L170-L204】.

Businesses trading internationally manage exchange‑rate risk by invoicing in their own currency, using forward contracts or currency options, sourcing inputs locally and diversifying into markets using different currencies.

| Economic situation | Consumer behaviour | Implications for business |

|---|---|---|

| Boom | High confidence; increased spending on non‑essentials. | Businesses expand; invest in capacity; may raise prices. |

| Recession | Low confidence; reduced spending; demand for essentials only. | Businesses cut costs; delay investment; focus on survival; intensify marketing to maintain sales. |

| High inflation | Consumers bring forward purchases; wages may rise. | Costs increase; pricing decisions become complex; possible wage‑price spiral. |

| High unemployment | Lower spending power; increased demand for low‑cost products. | Businesses may access a larger labour pool at lower wages; lower sales revenue from premium products. |

Examples and applications

During the 2008–09 global financial crisis, many economies experienced a recession. Consumers cut back on spending, causing demand for cars and luxury goods to plummet. Car companies such as General Motors closed factories and laid off workers to reduce costs. Governments responded with fiscal stimulus packages: the United States lowered taxes and spent billions on infrastructure projects to create jobs, while central banks lowered interest rates to encourage borrowing.

The COVID‑19 pandemic in 2020 led to another sharp downturn. Lockdowns caused unemployment to surge and businesses to shut temporarily. Online retailers and grocery stores saw increased demand, whereas airlines and hotels faced near‑zero revenue. Governments worldwide offered wage subsidies and loans to keep firms afloat.

Exchange rate movements can have major impacts. If the Pakistani rupee depreciates against the US dollar, Pakistani exports such as textiles become cheaper abroad, boosting sales, but imported machinery and fuel become more expensive. Conversely, a strong rupee makes imports cheaper but can hurt exporters. Businesses can hedge against currency risk by invoicing in their own currency or using financial instruments.